Lifetime ISA

Build a retirement or first home fund with a Stocks and Shares Lifetime ISA, and get a 25% government bonus on your investments.

Capital at risk. Initiate by 08.05.26 and keep invested until 08.05.27. Transfer £5,000 or more. Product rules and T&Cs apply. Compare benefits before transfer.

Award-winning investing

What is a Lifetime ISA?

Invest £100 or more in our Lifetime ISA (LISA) and get on the path to your first home worth up to £450,000 or retiring at 60, with returns protected from UK Income and Capital Gains Tax. You can open a new one if you're 18 to 39, transfer an existing one at any time, and keep paying in until you turn 50.

Invest up to £4,000

Use part of your ISA allowance each tax year.

Pay no tax on returns

What you do with the extra is up to you.

Get a 25% bonus on top

The government will add up to £1,000 a year.

Why choose our Stocks and Shares Lifetime ISA?

Personalised to you

Select the investment style and risk level that best suits your goals

Managed by us

Our team manages your globally diversified portfolio, which you can track anytime.

Expertise built in

Get real human support, expert insights, and regular market updates.

See our industry-beating results

We're proud of everything we do for our clients – especially our results. We show our full track record, so you can see how we compare to our competitors.

See our full performancePast performance is not a reliable indicator of future performance.

A Lifetime ISA to match your lifestyle

You can choose from our range of investment styles to find the right fit for your plans, and then we'll take care of the rest.

Speak to our wealth experts

Our team is here to help you feel confident you're getting the most out of investing. They'll discuss your strategy and explain which products could work best for your goals – so you can make an informed decision, every time.

Questions about anything else to do with investing? Just ask.

Book a free callIt's simple to transfer a Lifetime ISA to us

Do some checks first

Make sure you won't lose any benefits or get charged unexpected fees.

Open your new LISA

Customise your new LISA to suit your preferences and personal goals.

Start your transfers

Give us your existing LISA details and we'll get started on the admin.

What you'll pay for a Lifetime ISA

It's free to join us. The only fee is for our experts to manage your money, plus the cost and market spread of the funds we buy into for you. We also provide year-round free access to our insights, free financial guidance when you need it, and regular updates to investors straight from our investment desk.

Check our fees

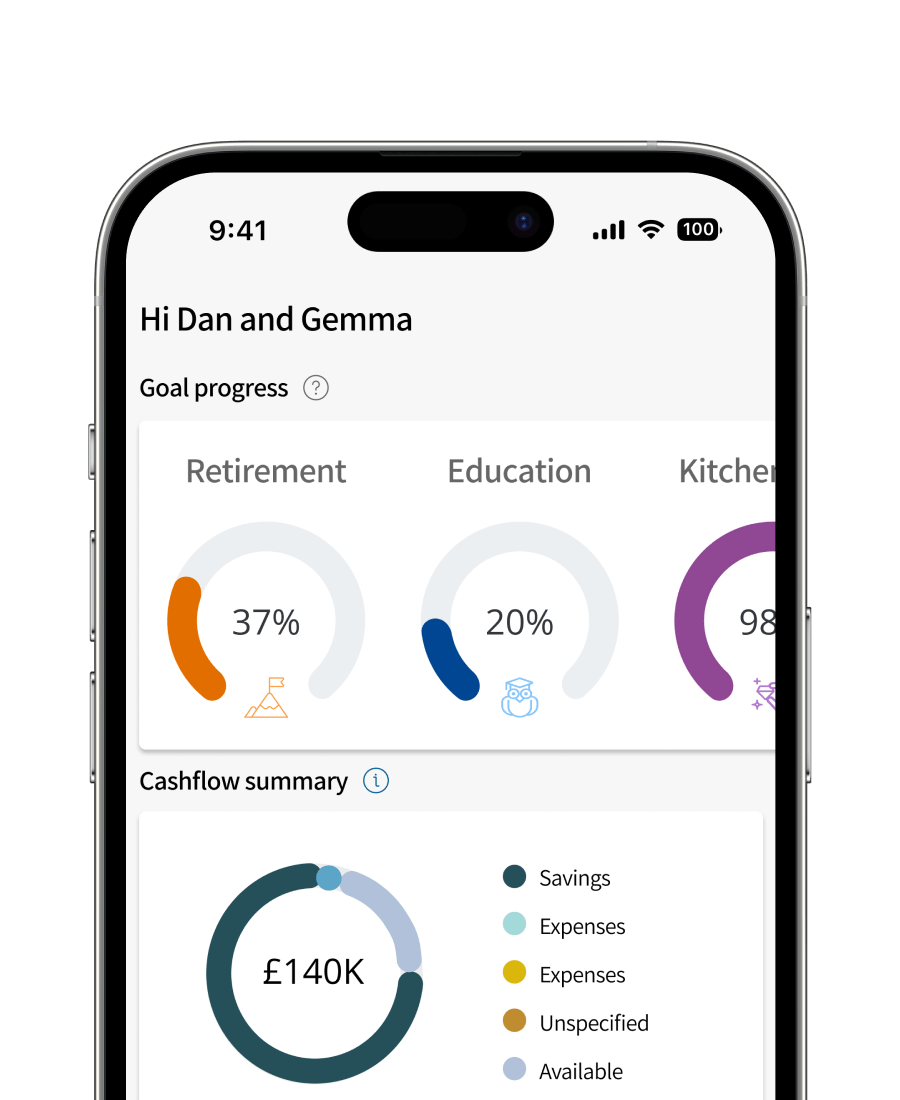

Coming soon: our free wealth planner

Exclusively for clients who invest with us, and designed to help you make confident decisions that could bring your goals closer:

- Build a view of your total wealth

- Get tailored suggestions to see how you could progress

- Test simulated scenarios for each suggestion

- Follow your progress tracker and make adjustments

Build a clear plan for tomorrow, so you can focus on today.

Doesn't provide advice.

Financial advice tailored to you

Need a hand with planning? Our advisers offer paid advice, assessing your portfolio and goals to see where your investments could run more smoothly. You'll receive a personalised financial plan based on our products and services, along with expert recommendations for structuring your finances to enjoy a stress-free retirement, planning for your family's future, and more.

Learn more about Lifetime ISAs

Invest like the experts

"Have a Help to Buy ISA from the old scheme? You can transfer it into a Lifetime ISA and give yourself a head start into the housing market or lock it away for retirement."

Other ways to invest

Invest for every goal with our range of products, all expertly managed by our in-house investment team.

Questions about Lifetime ISAs

How much can I pay into a LISA?

How much can I pay into a LISA?

You can contribute up to £4,000 each tax year up until you turn 50 – this counts as part of your annual ISA allowance of £20,000. You can only pay into one LISA each tax year, but you can open multiple cash and stocks and shares versions over time. For example, you could open and pay into a Stocks and Shares LISA one tax year, and then open and pay into a Cash LISA in the tax year after that, and so on.

How does the bonus work?

How does the bonus work?

The government will give you a 25% bonus on contributions. So if you pay in the maximum every year, you'll get £1,000. In other words, for every £4 you put in, you'll get an extra £1 on top.

Is a LISA better than a pension?

Is a LISA better than a pension?

If you’ve maxed out contributions in your pension and want to save more, a LISA could be a good option. If you choose to opt out of your workplace pension to pay into a Lifetime ISA, you may lose the benefits of the employer-matched contributions. Your current and future entitlement to means-tested benefits may also be affected. Not sure what's best for you? Book a free call to speak to our wealth experts.

Can I take money out of a LISA?

Can I take money out of a LISA?

Yes, you can withdraw money for free in three circumstances: to buy a first home that's £450,000 or less, when you turn 60, or if you're terminally ill. Withdrawing at any other time means you’ll pay a 25% government charge.

Can I use two LISAs to buy a house?

Can I use two LISAs to buy a house?

Yes, you can withdraw from multiple Lifetime ISAs at the same time to buy your first home. However, you will need to wait at least one year from the date of your first payment into each account, or you'll pay a 25% government withdrawal charge. If you're buying with somebody else who also has a LISA, you can use both as long as you're buying a property for £450,000 or less. Learn more about using a LISA to buy a house

Can I transfer in an existing LISA?

Can I transfer in an existing LISA?

Yes, it's simple to do on our website – but not currently possible on our app. Go to ‘Transfers’ in the left-hand sidebar of your online dashboard, fill out the transfer form, and post it to your current provider. We'll work with them to take care of the rest, and let you know when the transfer is complete – transfers usually take around three weeks.

More questions? Check our Lifetime ISA FAQs.

As with all investing, your capital is at risk. The value of your portfolio can go down or up and you may get back less than you invest. Tax rules vary by individual status and may change. If you withdraw the money before you’re 60, and it’s not to buy a qualifying first home, you may pay a 25% government withdrawal charge. If you opt out of your workplace pension to pay into a Lifetime ISA, you may lose the benefits of the employer-matched contributions. Your current and future entitlement to means-tested benefits may also be affected. We provide 'restricted advice', meaning we only make investment recommendations on the products and services that we offer.